Banks

Churpy, a Kenyan Fintech Startup Raises $1M for its Expansion in Africa

Churpy, a Kenyan fintech startup founded in 2021 has raised $1 M in seed funding. The company plans to set up hubs in Nigeria, Egypt, and South Africa in order to facilitate its growth across Africa.

Unicorn Growth Capital directed the seed-funding round with investors including Antler East Africa, Nairobi business angel network, and some of Rally Cap’s LPs including senior executives from Stripe also participating.

Churpy is set to change how businesses manage the debt owed to them by their customers through its software, (SaaS) as a product that automates the process of reconciling incoming payments and invoices. This labor-intensive process is still generally manual for most companies.

The company’s platform will enable companies to access real-time statements and transaction data for use to reconcile pending invoices from enterprise resource planning systems (ERPs) used to track company activities like accounting and supply chain operations.

The startup is already steering a pilot program in the country with some of the major manufacturing and service enterprises, including Unga Limited and Chandaria Industries.

Churpy’s co-founder and CEO, John Kiptum says that it was not hard “for us to unlock a lot of ideas, products, innovation, and tech around the financial industry space. We have been there; we have seen how it works or why it does not work, why it is slow, why it is ineffective, and why customers are not happy. And so, what we are building is inspired by real experiences.”

Furthermore, the startup is set to roll out a working capital financing product targeting small-medium enterprises.

“SMEs have a huge financing gap. They are the suppliers to these big companies and need capital to keep taking raw materials to their other clients. Usually, they need collateral to access loans from banks and wait for approval to access capital to keep their business going. What we are doing is ensuring that they are paid not long after they deliver goods to collaborate with enterprises for a 0.5% origination fee. Once their invoice matures, we get paid,” said Churpy’s co-founder.

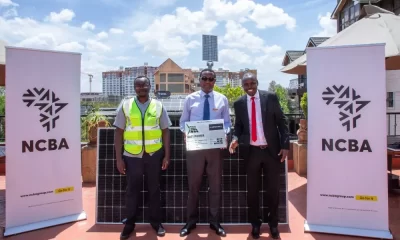

The Fintech startup has collaborated with some of the largest banks in the region — including Citibank, Sidian, Stanbic, and NCBA through its API. In order to extend financing to SMEs, Trade Development Bank has made $15 million available to Churpy to be distributed via its banking partners for onward lending.