Features

How to File Nil Returns

Filing KRA Nil Return is allowed for taxpayers who do not have any source of income. Any citizen with an active KRA Pin Number and does not have any income is supposed to file his/her KRA Nil Returns between 1st Jan -30th June each year.

Steps to file your Nil Returns:

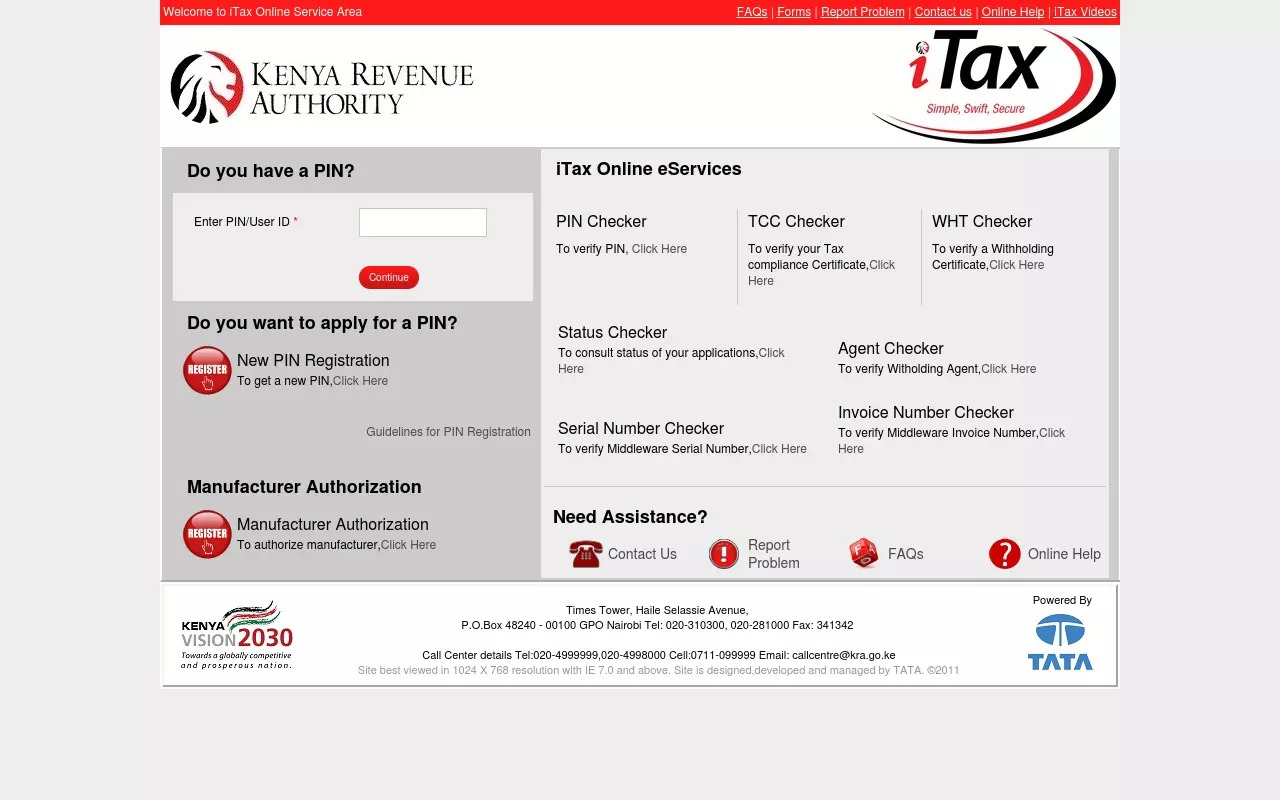

Go to the itax portal at itax.kra.go.ke

- Enter your KRA pin and password and Log in.

- If you have forgotten your password, there is an option of forgot password.

Once you are logged in, update the professional details and go to the returns menu and select File Nil Return

Click on the Tax Obligation and choose Income tax Resident.

Write down the period you are filing the Nil Return and to what period the Nil Return is valid. Click submit.

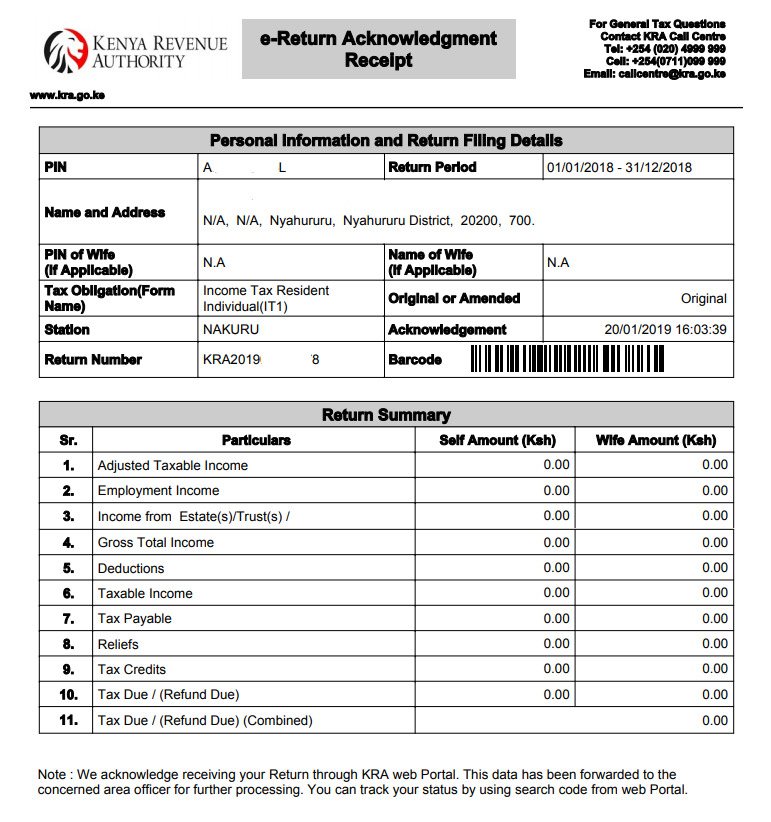

Download the Return receipt.

-After the successful submission of your KRA Nil Returns, a return receipt will be generated with an acknowledgment number. Download the returns receipt and print a copy of it.

Print the Acknowledgement Receipt.

-This is the last indication that you have filed your returns.

By Joy Ngoiri