Learning

6 Financial Tips For Young Adults In Their 20s

Taking steps sooner than later to manage your financial affairs will not only set you up for success later in life, but will also help protect your hopes, dreams, and goals when life throws you a curveball. When you are in your 20’s you have time on your side which is a huge advantage when it comes to personal finances and planning financially.

- Develop good money habits

While in your 20s, consider ways you can build good money habits and be proactive with your finances. Practice Self-Control and avoid situations that will lead you to make impulsive money decisions. Get into the habit of regularly checking your different account balances. Make sure to spend within your means and avoid racking up unnecessary debt and paying high interest charges. Do not get carried away charging a lifestyle you cannot afford.

- Live within your means

Before you can live within your means, you need to know what your means are. Create a realistic spending plan using an interactive budget calculator that helps you adjust your budget until it balances. Track your expenses to get accurate details about your spending habits and adjust your budget accordingly. Ensure that you are saving for long and short-term goals and developing positive money skills and habits. Once your budget is balanced and you are not spending more than you earn, then you are living within your means.

- Choose a partner and friends who share your money values

Living within your means also means choosing friends, and especially a partner, who share your values. Living lavishly when you cannot manage to maintain the lifestyle will leave you in debt. If you do not learn how to manage your money, then other people will find ways to mismanage it for you. If your friends routinely spend more than you are comfortable spending, get to know new friends who share your money values and who support your financial lifestyle choices.

- Start Saving now

Open a bank account and research on the different saving options they offer. One of the most-repeated mantras in personal finance is “pay yourself first,” which means saving money for emergencies and for your future. This simple practice not only keeps you out of trouble financially, but it can also help you sleep better at night.

A good example of a financial institution you can bank with is Standard Chattered. You can take advantage of the many saving products such as Safari Savings Account and Safari Junior Accounts for the young ones. You can join a SACCO and Chamas where not only are you looking to make returns but also you get to expand your money’s capability to work for you.

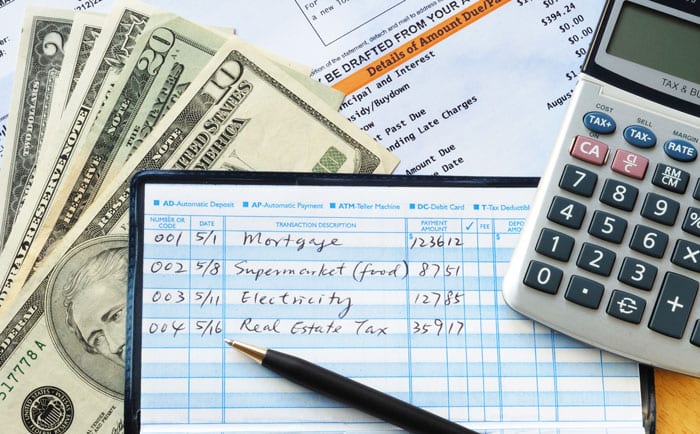

- Create a budget and stick to it

Creating a budget is an important financial step that can help you get your finances in order and track how much money comes in and out of your bank account every month. While it may seem like a lot of work to create a budget, there are numerous online resources and apps that can help you. Once you have one, most of the work is done, and you can tweak it as your spending habits or income change.

After you create a budget, it is important to stick to it. Regularly check-in with your budgeting goals so that you do not spend more than you can afford to repay. And if you share expenses with someone else, make sure you both have access to the budget and hold each other accountable.

- File your Tax returns

Filing your income taxes is part of a smart money management strategy, however there are countless reasons why some people may not be able to do so. Learn how to file your taxes so that you avoid being on the radar of the taxman.

To conclude, making smart money decisions in your 20s has long-term benefits that can help you achieve future financial success. If you follow the six tips listed above, you can work towards being debt-free and saving money and major life milestones. Start right now. The younger you are, the more time your money has to grow.