Business

Safaricom wants to Bring back No-Interest Loans for Shopping

A zero-interest credit service for the purchase of goods that was previously blocked by the Central Bank of Kenya (CBK) hours before the launch is being brought back by Safaricom.

The chief executive of Safaricom, Peter Ndegwa, said that the telco is making changes to the “Faraja” product as requested by the CBK and that it will “surely show up.”

Owner of the Faraja product is EDOMx Ltd, a financial technology company with offices in Kenya that has listed Equity Bank and Safaricom among its partners.

“I am sure it will show up. We needed to change a few things. We will bring it back. It needs to be approved normally just in the same way CBK approves (other products). It is a use case that customers want. You will see it come back,” said Mr Ndegwa.

In a move that would upend the mobile loans industry, Faraja would let millions of Safaricom customers shop for items up to Sh100,000 and pay later, interest-free.

According to media invites, the product was scheduled to launch on July 6 of last year, and Safaricom had loaded the terms and conditions of the product, but the CBK halted the event.

The CBK’s demands for changes to the product that promised standard M-Pesa transaction fees as the only costs at the point of sale and payment within 30 days are unclear.

The CBK requires regulated businesses to provide features, customer terms of agreement, fees charged, and documentation of risk mitigation measures prior to the launch of a product.

The product’s viability, tax implications, and proof that it won’t violate statutory or prudential requirements are additional requirements.

The CBK also mandates that businesses disclose their complaint resolution procedures, maintain the privacy of customer information, and abstain from coercive selling and undue customer pressure.

Faraja is a little like the market’s “Lipa Later” service, except that customers can walk away with their purchases from a list of chosen merchants without having to pay for them in full up front or in instalments this time.

The product is expected to disrupt the mobile loan market and compete with other interest-bearing credit products like Fuliza, KCB-M-Pesa, M-Shwari, as well as digital credit providers like Tala, Branch, and Zenka.

Due to the increase in Lipa na M-Pesa transactions at specific stores, Safaricom and Equity were interested in profiting from Faraja.

Numerous businesses had registered to be merchants, including Naivas Supermarket, Goodlife Pharmacy, and City Walk.

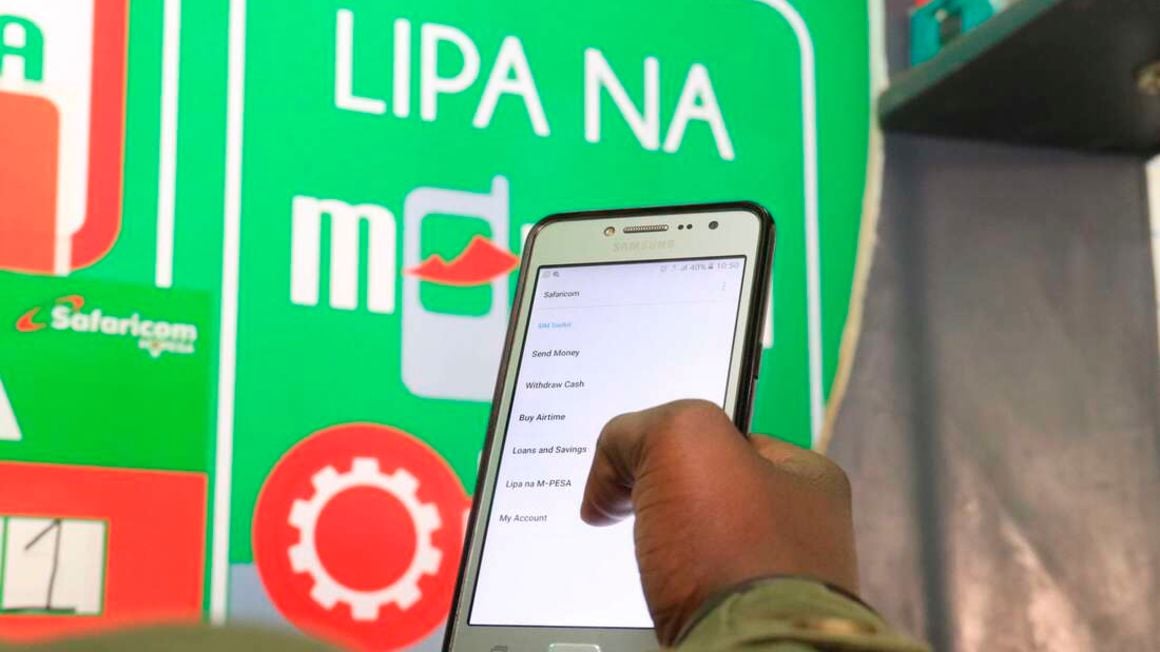

In June 2013, Safaricom introduced Lipa na M-Pesa, and since then, it has actively sought out both big and small businesses, including gas stations, supermarkets, corner stores, and restaurants, to sign up to use the service.

The number of active merchants on the platform, which allows businesses to transact using a till number that customers use to pay, increased by 23.1% to 606,662 in the fiscal year that ended in March 2023 from 492,772 the previous year.

Sh1.63 billion worth of transactions were made using Lipa na M-Pesa during the fiscal year under consideration. By 2021, Safaricom was generating Sh40 million in revenue per month from the product.

Depending on the value of the transaction, lipa na M-Pesa fees range from Sh23 to Sh210.

M-Pesa was founded by a telco in 2007, and since then, it has expanded beyond just sending and receiving money.

Fuliza, an overdraft facility that enables users to complete transactions even when their mobile money wallets are empty, is one of the additional features associated with M-Pesa.

Fuliza ya Biashara, a service that allows business owners to access unsecured credit of between Sh1,000 and Sh400,000 by overdrawing on M-Pesa business tills to cover short-term cash flow shortfalls, was launched by Safaricom at the beginning of the month.