Acquisitions

Equity Group Acquires Controlling Stake in Rwandan Bank

As part of its mission to diversify in the East African market, Equity Group will pay RWF54.68 billion (Sh6.67 billion) for its controlling stake in a Rwandese bank.

The lender revealed yesterday that it had reached a deal to buy 91.93 percent of Compagnie Générale De Banque Plc (Cogebanque) from the Rwandan Government, the Rwanda Social Security Board, Sanlam Vie Plc, and Judith Mugirasoni (together, the seller).

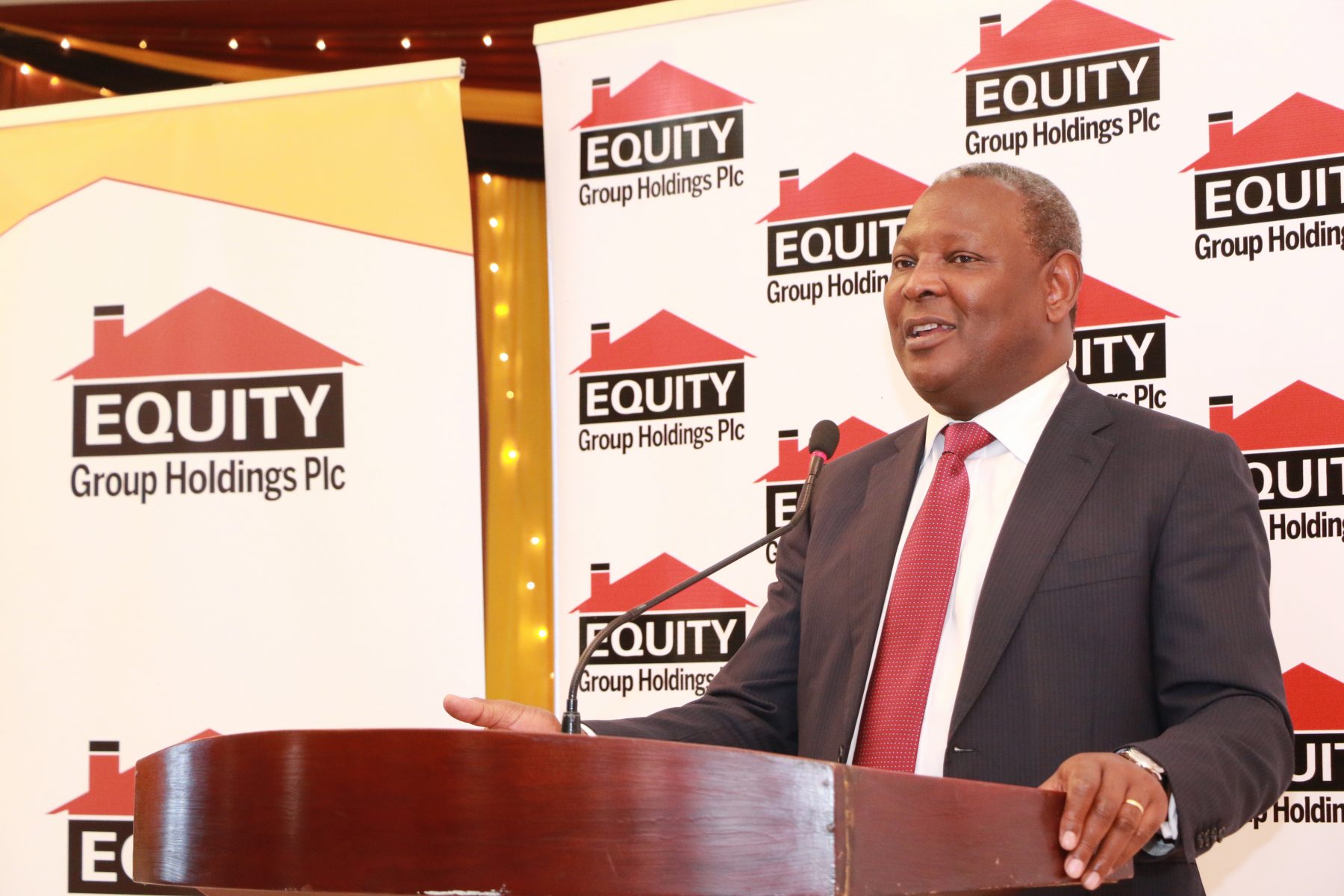

“By acquiring Cogebanque, EGH will be able to expand its footprint and consolidate its position in Rwanda,” Equity Group managing and CEO James Mwangi said.

“Further, EGH through the combined businesses of Equity Bank Rwanda Plc and Cogebanque, aims to provide even better access to competitive, tailored financial services to improve lives and livelihoods of the people of Rwanda, expand opportunities for wealth creation whilst also delivering significant value to its stakeholders.”

In 2020, Equity’s attempts to acquire 62 percent of the share capital of the Rwandan Banque Populaire du Rwanda were unsuccessful.

As it competes with other financial institutions like the Kenya Commercial Bank (KCB), the acquisition will increase Equity’s market share in the region.

“Until further announcements regarding the Cogebanque Acquisition are made, the shareholders of EGH and other investors are advised to exercise caution when dealing in EGH ordinary shares on the Nairobi Securities Exchange, the Uganda Securities Exchange, and the Rwanda Stock Exchange,” Mwangi added.

Equity Group reported an Sh46.1 billion net profit for the fiscal year that ended on December 31, 2022, helped by greater earnings on the Kenyan unit.

Compared to the Sh40.1 billion that was reported in a comparable time in 2021, it represented a 15% year-over-year gain.