Banks

CBK Anticipated to Keep Key Policy Rate on Hold

Central Bank of Kenya (CBK) is expected to retain its benchmark lending rate at June’s historic rate hike to 10.5 percent during a meeting of its key policy organ tomorrow in order to further anchor inflation expectations.

The Monetary Policy Committee (MPC), which oversees the banking industry, increased the policy rate from 9.50% at the previous meeting on June 26 by 100 basis points.

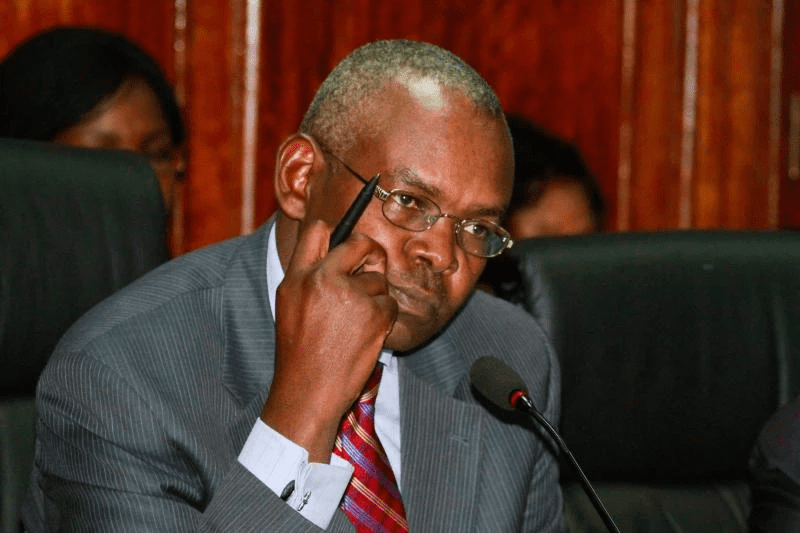

One week after taking office, Kamau Thugge, the new governor of the CBK, held an unscheduled meeting of the committee to raise the policy rate.

The decision was made in response to unexpectedly higher-than-expected inflation in May, which rose to 8% from a 10-month low of 7.9% a month earlier and beat market expectations of 7.53%.

However, economists currently believe the central bank may keep the present rates at tomorrow’s MPC meeting due to slowing inflation and concerns that a further increase in the Central Bank Rate (CBR) rate could stifle economic growth.

“We expect the MPC to maintain the Central Bank Rate at the current rate of 10.50 percent, with their decision mainly supported by the ease in y/y inflation in July 2023 and the need to support the economy by adopting an accommodative policy that will support the private sector,” noted an analysis by investment firm Cytonn.

According to government statistics, Kenya’s core inflation, which includes products and services outside food and fuel and is a better indicator of the underlying trend in prices, decreased from 7.9% in June to 7.3% in July.

The decline, which also exceeded the central bank’s target range sooner than anticipated, was nonetheless noticeable despite an increase in petrol prices that pushed up transportation costs.

“Based on the recent adjustments in the economic numbers and slowed political happenings, I can only see this go one way, the MPC to retain the current benchmark lending rate…I do not see why they should increase it when things are beginning to align, economically,” Peter Macharia, an economist and the CEO of Jijenge Credit.

According to reports from Bloomberg, Thugge stated earlier this month that he anticipates inflation to return to the goal range of 2.5 percent to 7.5 percent by October.

Data from the Kenya National Bureau of Statistics (KNBS), reflects the lowest annual inflation since May 2022, when it was 7.1%. Surprisingly, the country’s private sector activity decreased during the relevant month, hampered by poor consumer purchasing power, high inflation, and sluggish operations in the services, wholesale, and retail sectors.

The Purchasing Managers Index (PMI) for the month of July 2023 released by Stanbic Bank during the week, showed that the index dropped from 47.8 in June 2023 to 45.5 in July 2023, indicating a more severe decline in the business environment at the beginning of the third quarter of 2023.