Banks

Equity Bank CEO gives up Sh471m in dividend reversal

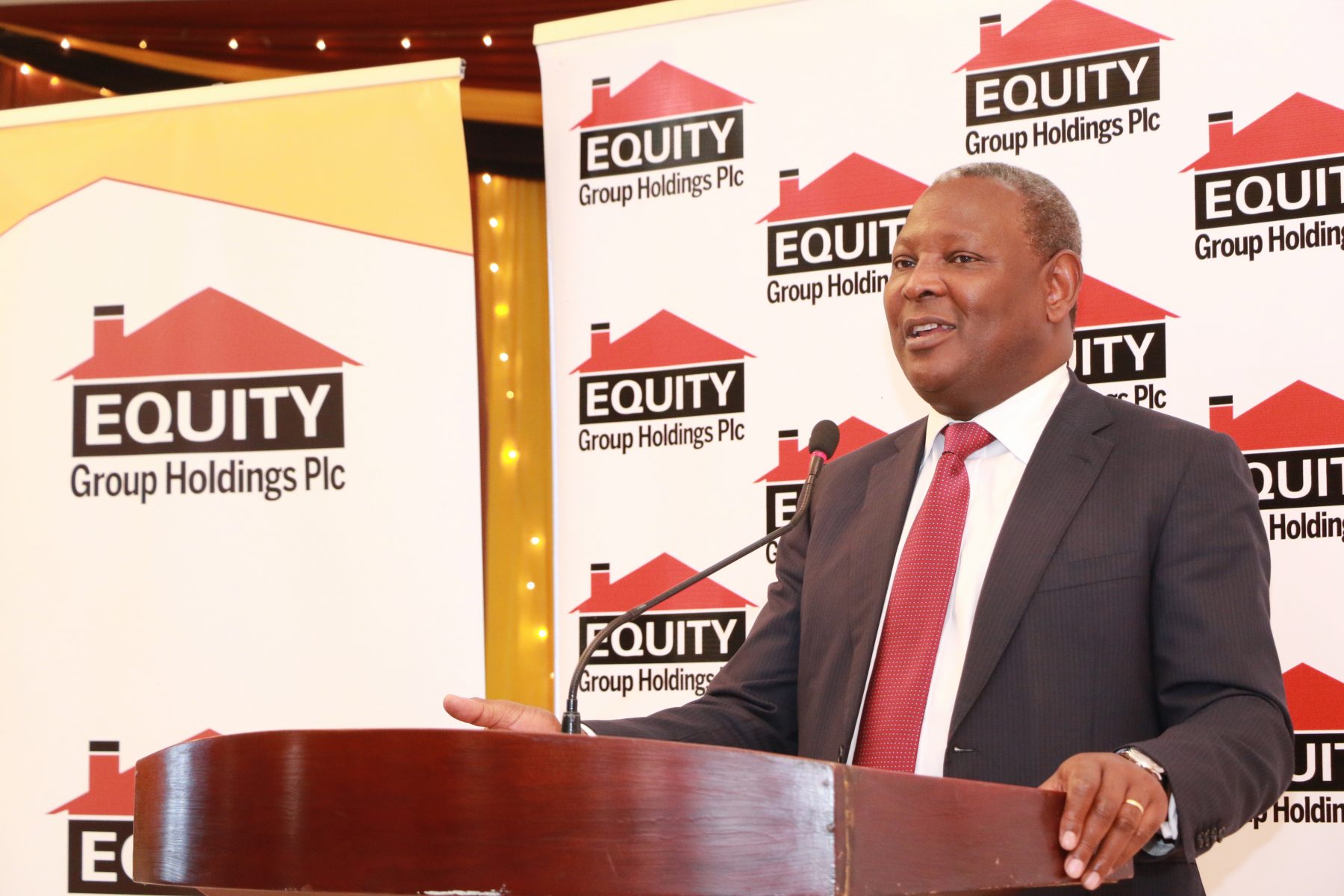

Equity Banks CEO, James Mwangi, will forgo Ksh471 million in dividends together with other shareholders including pensioners, billionaires and institutional investors.

This move comes after the lender cancelled its proposed payout of Sh2.5 per share or a total of Sh9.4 billion.

Britam Holdings, Equity Bank founder and former chairman Peter Munga, the National Social Security Fund (NSSF) and JPMorgan Asset Management (UK) Limited will also forgo their dividends of between Sh38.5 million and Sh689.2 million each, in estimates, which was scheduled to be given on July 24 but the bank withdrew the payout last week, citing the need to preserve cash in the wake of the Covid-19 pandemic.

Britam is among the biggest losers, having anticipated a Sh689.2 million payout.

Mr. Mwangi is second after forfeiting the Sh471.7 million while the NSSF will miss a Sh300.2 million payout,

Equity was to close its books for the dividend on June 12.

Mr Munga, whose holding was last disclosed at 15.4 million shares, would have earned a dividend of Sh38.5 million.

However, the Investment banker Jimnah Mbaru said Equity should issue a dividend in the form of shares.

“Equity Bank should have issued a scrip dividend in order to preserve cash instead of skipping the cash dividend previously announced. Shareholders would get the same dividend by selling the scrip shares on the stock exchange,” he tweeted.